SECR FAQs

Scroll down the page and click the question you are interested in.

If you have a question that is not on the list below, please either e-mail: [email protected] or call: 03333 448 499

Please note, we accept no liability for the answers provided. For all queries, please seek additional legal advice.

The definition of a Large Company is:

The qualifying conditions are met by a company or LLP in a year in which it satisfies two or more of the following requirements:

• Turnover £36 million or more

• Balance sheet total £18 million or more

• Number of employees 250 or more

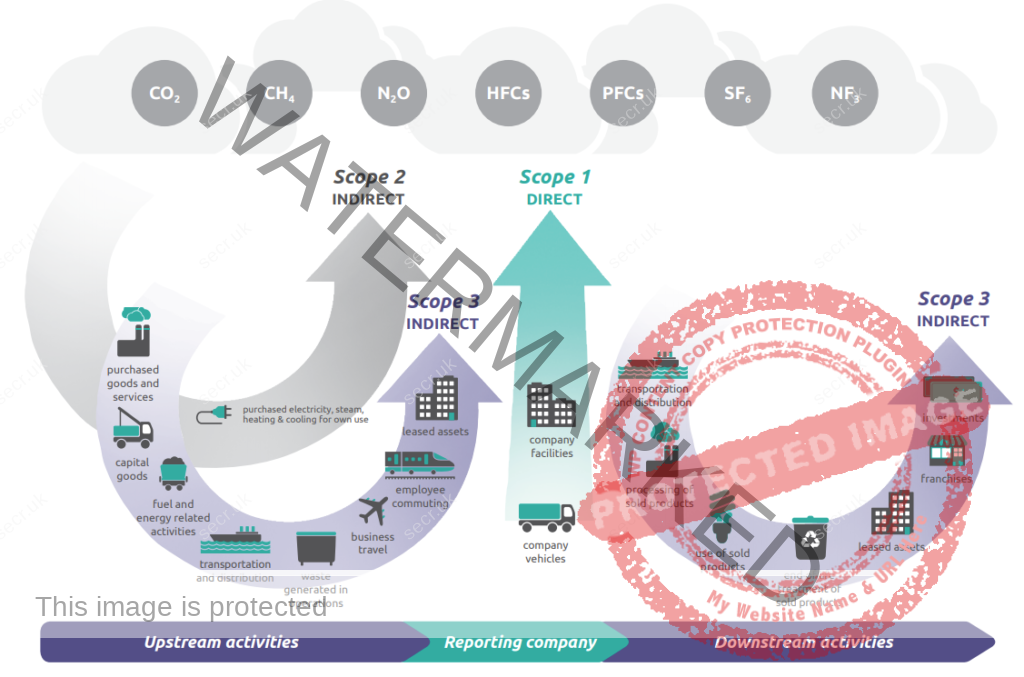

What does Scope 1, Scope 2, Scope 3 mean?

The different Scopes should be considered as different categories in which carbon emissions produced by your organisation are grouped.

Scope 1 (direct emissions) emissions are GHG emissions that occur from sources owned or controlled by the company. Examples of scope 1 emissions include emissions from combustion in owned or controlled boilers, furnaces, vehicles; emissions from chemical production in owned or controlled process equipment.

Scope 2 emissions (energy indirect) are emissions being released into the atmosphere associated with your consumption of purchased electricity, heat, steam and cooling. These are indirect emissions that are a consequence of your organisation’s activities but which occur at sources you do not own or control.

Scope 3 emissions (other indirect) are emissions that are a consequence of your actions, which occur at sources which you do not own or control and which are not classed as scope 2 emissions. Examples of scope 3 emissions are business travel by means not owned or controlled by your organisation, waste disposal, or purchased materials or fuels.

Below is a useful image from GHG Protocol’s ‘Technical Guidance for Calculating Scope 3 Emissions’ describing the different types of emission scopes.

Companies within a group compliance:

If a group directors’ report is required, and the aggregate totals of the consolidated group mean that the group has to report under SECR, but none of entities within the group (subsidiaries or parent) qualify at individual level, the parent may be exempt from full disclosures in the group directors’ report if a statement is included that nobody in their group meets SECR requirements at an individual level.

We are part of a group of companies, do we need to comply as individuals

If you are reporting at group level, for a financial year for which you are required to prepare a group Directors’ Report, when making your energy and carbon disclosures, you must take into account not only your own information, but also the information of any subsidiaries included in the consolidation which are quoted companies, unquoted companies or LLPs. However, you have the option to exclude from your report any energy and carbon information relating to a subsidiary which the subsidiary would not itself be obliged to include if reporting on its own account. The same applies to LLPs required to prepare a group Energy and Carbon Report.

If you are reporting at subsidiary level, for a financial year for which your parent company (or parent LLP) is preparing a group relevant Report (i.e. a group Directors’ Report or a group Energy and Carbon Report), you might not be obliged to include your energy and carbon information in your own accounts and reports. A subsidiary is not obliged to report their energy and carbon information if:

• They are a “subsidiary undertaking” at the end of the relevant financial year;

• They are included in the group Report (whether a group Directors’ Report or a group Energy and Carbon Report) of a “parent undertaking”;

• That group Report is prepared for a financial year of the parent that ends at the same time as, or before the end of, the subsidiary’s financial year; and

• The group Report complies with the relevant obligations on the parent to report energy and carbon information for themselves and their subsidiaries; but this provision does not apply where the group Report relies on the seriously prejudicial option.

Overseas parent companies:

If a business is required to report under SECR legislation and has a foreign parent, they would be submitting their SECR data to Companies House in their own directors’ report and based on the requirements that would apply to them as an individual entity.

Overseas parent companies listed on the foreign stock exchange:

For the purposes of SECR, a quoted company is defined in section 385(2) of the Companies Act 2006 as a company that is UK incorporated and whose equity share capital is listed on the Main Market of the London Stock Exchange UK or in an EEA State, or admitted to trading on the New York Stock Exchange or Nasdaq.

If a business is required to report under SECR legislation and has a foreign parent, they would be submitting their SECR data to Companies House in their own directors’ report and based on the requirements that would apply to them as an individual entity.

Are universities, housing associations, multi academy trusts and public sector bodies in scope of SECR?

If the organisation is required to prepare a Directors’ Report under Part 15 of the Companies Act 2006, and if it is quoted or considered ‘large’ then it is in scope of SECR regardless of its activities in the public, charitable or education sectors.

The electricity we purchase is on a 100% renewable tariff. Do we report this as zero emissions?

In this situation, the regulators recommend that you duel report, calculating emissions using the reporting years conversion factors and market based emissions factors for the renewable tariff. It should be noted that as the UK’s grid is a mix of renewable and non-renewable sources, companies that purchase a 100% renewable tariff are effectively increasing the non-renewable proportion of energy consumed by non-renewable tariff users.

We are a quoted (UK incorporated) company, do we need to report non-UK emissions for foreign subsidiaries?

The Government state: Quoted companies should report on the global energy use and emissions that the group, headed by that company, is responsible for, and it is for the reporting entity to apply this test in relation to their global operations. The legislation also sets out that organisations should reports separately on UK and non-UK energy and emissions.

Do we have to report employee commuting?

Employee commuting in vehicles not owned or controlled by your organisation is Scope 3 emissions and its reporting under SECR is optional.

Do I have to break down my energy consumption by site?

You do not need to breakdown your energy consumption by site. Our online carbon calculator requires that you enter a cumulative figure for all sites (e.g. enter a combined gas total for all sites and a combined electricity total for all sites). Use our free conversion calculators to convert your mains gas, LPG, oil etc. in to kWh. However, make sure you do not combine different energy supplies or sources. E.g. if you have converted your mains gas and LPG consumption to kWh, do not combine the two figures, report each separately. This applies to different transport types, do not combine your fleet consumption and grey fleet consumption (grey fleet = staff using own vehicles and claiming back mileage).

We believe we are low energy users (less than 40 MWh) do we have to comply?

We would recommend that you confirm that you are a low energy user. 40 MWh (40,000kWh) is actually not that much (roughly the typical annual energy consumption of two medium sized domestic houses). Importantly, you need to include any transport energy you have consumed over the assessment period (including staff claiming back miles using their own vehicles – grey fleet). An average diesel car travelling 20,000 miles per year consumes ~ 22.8 MWh of energy.

If you have confirmed that you are a ‘low energy’ user, the regulations states that you are not required to make the detailed disclosures of energy and carbon information. Instead, such an organisation is required to state, in its relevant report, that its energy and carbon information is not disclosed for that reason.

The guidance states the following in respect to qualifying as low energy users:

• A quoted company preparing a Directors’ Report which has consumed 40MWh or less during the period in respect of which the report is prepared. If the quoted company is preparing a group Directors’ Report, the assessment is of the energy consumption of the parent and its subsidiaries which are included in the consolidation and are quoted companies, unquoted companies or LLPs. In assessing whether or not the 40MWh threshold is met, companies in scope must consider all the energy usage as defined in section 6 of the guidance.

• Unquoted companies or LLPs preparing a Directors’ Report or Energy and Carbon Report which have consumed 40MWh or less in the UK, including offshore area, during the period in respect of which the report is prepared. If the company or LLP is preparing a group Report, the assessment is of the energy consumption of that parent and its subsidiaries. In assessing whether or not the 40MWh threshold is met, companies in scope must consider all the energy from gas, electricity and transport fuel usage as defined in section 7 of the guidance.

How are SECR regulations enforced?

This is what the guidance states:

The Conduct Committee of the Financial Reporting Council is responsible for monitoring compliance of company reports and accounts with the relevant reporting requirements, imposed on companies by Part 15 of the Companies Act 2006 (“the Act”) and imposed on LLPs, as that Act has been applied to LLPs.38 The Committee has the power to enquire into cases where it appears that relevant disclosures have not been provided. The Committee also has the power to apply to the Court, under section 456 of the Act, for a declaration that the annual report or accounts of a company or LLP do not comply with the requirements and for an order requiring the directors to prepare a revised report and/or set of accounts.

As far as possible, however, the Conduct Committee operates by agreement with the businesses whose reports it reviews and, to date, has achieved its objectives without recourse to the Courts. The Committee exercises its functions with regard to the principles of good regulation, including proportionality, consistency and targeting. It raises concerns with companies where there is evidence of apparent substantive non-compliance.

Companies House register company and LLP information and make it available to the public. Companies House may not accept any accounts that do not meet the requirements of the Companies Act, and where acceptable accounts are delivered after the filing deadline, the company is liable to a civil penalty in accordance with section 453 of the Companies Act 2006. The civil penalty for the late filing of accounts is in addition to any action taken against directors (or members of an LLP), under section 451 of the Act.

The Government will work with Companies House and the Financial Reporting Council to support implementation, and to monitor how organisations respond to the new reporting requirements as part of its overall responsibility to review the impact of the legislation on businesses and the wider economy.

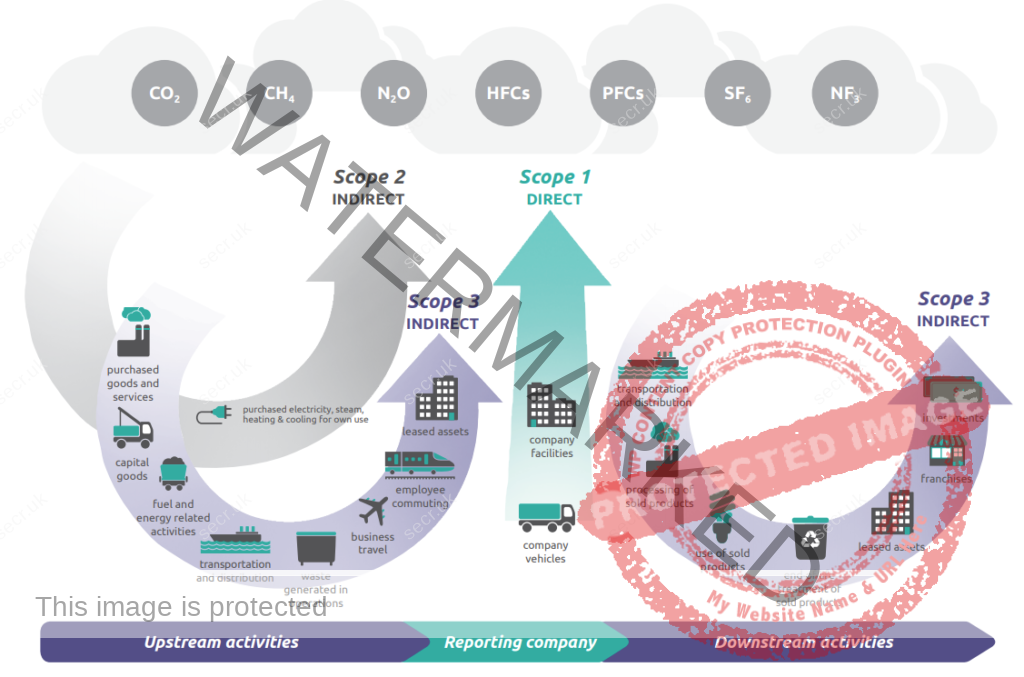

What are scope 3 emissions? Do we have to include them?

The guidance defines Scope 3 emissions as:

‘Emissions that are a consequence of your actions, which occur at sources which you do not own or control and which are not classed as Scope 2 emissions. Examples of Scope 3 emissions are business travel by means not owned or controlled by your organisation, waste disposal which is not owned or controlled, or purchased materials.’

For quoted companies, the reporting of Scope 3 emissions is voluntary but strongly encouraged.

SECR legislation requires unquoted companies to disclose energy use and related emissions from business travel in rental cars or employee-owned vehicles.

All other scope 3 emission disclosures are voluntary but strongly encouraged.

Below is a useful image from GHG Protocol’s ‘Technical Guidance for Calculating Scope 3 Emissions’ describing the different types of emission scopes.

Do we have to report energy generated from our solar panels?

The guidance states:

‘While explicit reporting on renewable energy and associated emissions is not a mandatory requirement under the SECR legislation, organisations are

encouraged to use dual reporting if they wish to reflect their consumption of renewable energy’.

In accordance with the 2009 Guidance, you may report an emissions reduction in your reported net CO2e figure for any renewable electricity that you have generated and exported to the national grid or a third party. The emission reduction should be calculated using the grid average factor. Total emissions reductions from generated and exported renewable electricity (and green tariffs if appropriate) must not be greater than gross scope 2 emissions.

2009 guidance states:

Where your organisation generates electricity from ‘owned or controlled’ renewable sources backed by Renewable Energy Guarantees of Origin (REGOs) within the UK:

• You should account for renewable electricity generated at zero emissions in Scope 1;

• You should account for all electricity purchased for own consumption from the national grid or a third party at the ‘Grid Rolling Average’ factor (irrespective of the source of the electricity)

• You may report an emissions reduction in your reported net CO2e figure for any renewable electricity that you have generated and exported to the national grid or a third party at the ‘Grid Rolling Average’ factor. The amount reported in this way should not exceed your actual electricity use

Do we report serviced office energy

The guidance states:

Organisations in scope of SECR should report all energy use and associated GHG emissions (as defined in the previous sections of this chapter) that they are responsible for. In the case of landlord/tenant arrangements, the party responsible for the consumption of energy should take the responsibility for reporting of it under this legislation. This should include consumption of energy in rented serviced areas, where a tenant would report on energy consumption, despite not being directly responsible for its purchase, if information on energy consumption is available through sub-meters for example or provide estimates where information is not available.

GHG guidance states:

Some companies may be able to demonstrate that they do not have operational control over a leased asset held under an operating lease. In this case, the company may report emissions from the leased asset as scope 3 but must state clearly in its GHG inventory report the reason(s) that operational control is not perceived (for companies reporting under Operational Control).